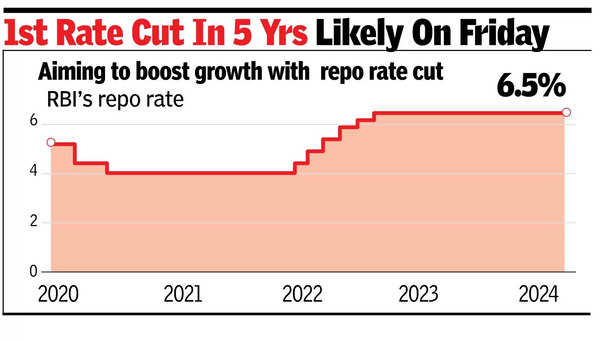

MUMBAI: RBI’s monetary policy committee began its meeting on Wed and is expected to end its longest pause with a rate cut on Friday, the first in nearly five years.

The last rate cut was in May 2020 when RBI lowered the repo rate to 4% to support the economy during the Covid-induced lockdown. It later raised rates seven times to 6.5% due to inflation amid the Ukraine war, supply chain disruptions, and global price surges. The pause has remained since Feb 2023.

Most economists expect a 25bps cut, but some believe it would be premature if US President Donald Trump escalates tariff threats, worsening financial market volatility. Lower interest rates could also pressure the rupee, making US debt more attractive for foreign investors.

Dipanwita Mazumdar, an economist at Bank of Baroda, said risks to growth from uncertainty, highlighted in the IMF’s latest report, could prompt RBI to start cutting rates. “For other economies, rate cuts began earlier, giving them room for a ‘wait and watch’ approach,” she said. “Balancing macro and geopolitical factors, we believe there is space for a 25bps rate cut.”

The policy meeting includes two new RBI members – governor Sanjay Malhotra and deputy governor M Rajeshwar Rao – who will be attending the meeting for the first time in place of their predecessors Shaktikanta Das and Michael Patra, respectively. Malhotra recently announced liquidity measures injecting Rs 1.5 lakh crore, seen as paving the way for rate transmission. A liquidity deficit could keep borrowing costs high even if RBI cuts rates. Govt has supported a rate cut.

Unews World

Unews World