Finance firm Plum has launched a new artificial intelligence tool which will be able to help users decide what to do with their money – and potentially nudge them towards better returns on their cash.

The government is rewriting the rule book on what banks and other financial services can do in a bid to bridge a knowledge gap, as currently anyone who cannot afford professional financial advice could miss out on the best guidance.

In addition, Rachel Reeves has begun a push to encourage more people to invest in the stock market, which historically offers better rewards than purely saving.

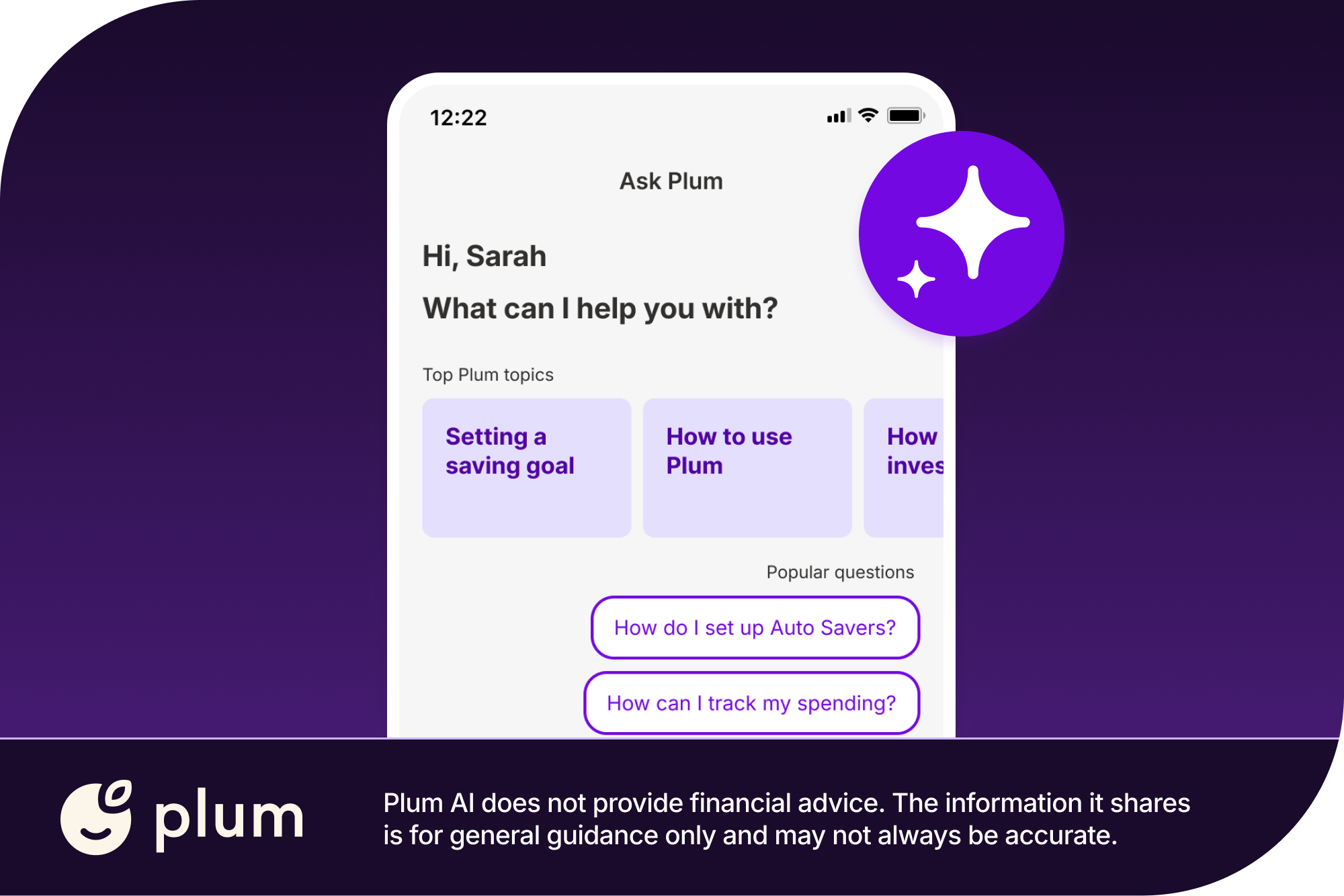

Bridging both those trends is Plum’s new addition to the app which sees the built-in AI agent able to both prompt users about their income and long-term goals, and also direct them to where that money might be best-placed or where to cut costs.

The ‘Ask Plum’ feature is originates from a base of Google’s Gemini, with a specific build to be able to identify which Plum products or accounts might best serve a user’s needs.

Currently, several other banking apps offer features which might be AI-based, such as identifying areas of increased spending, but Plum’s appears the first in the UK which aims to fully embrace a conversational aspect between user and app to help inform better choices.

An exclusive preview for The Independent showed how the feature will work, with the app prompting the user with a series of questions to gauge their current financial resilience, how much free money they may have each month to save or invest and discern their tolerance to risk.

A spokesperson for the firm explained how research showed decision making is the most difficult part for many people to make the best use of their finances, which this tool aims to simplify and help with.

Users are able to link their accounts with other banks within the app to give a clearer overall picture of their current financial status, whether or not they use the AI service.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

The AI tool will be available to all users, though some features such as spending insights are only currently open to paid tiers.

Banks will soon be able to use “targeted support” to get in touch with people whose financial situations might make them better off starting to invest.

The longer-term plan will see Plum’s built-in agent also be able to suggest such moves, where there is risk appetite from the user to do so. Users will still be encouraged to undertake their own research as to whether the move is the right one for them.

While Plum itself is not a bank, it is FSCS protected and holds users’ funds in a range of other banks including Investec, Citibank and Lloyds.

Source link

Unews World

Unews World