Business reporter, BBC News

Getty Images

Getty ImagesUK inflation rose sharply last month after airfares failed to fall by as much as usual and private school fees jumped.

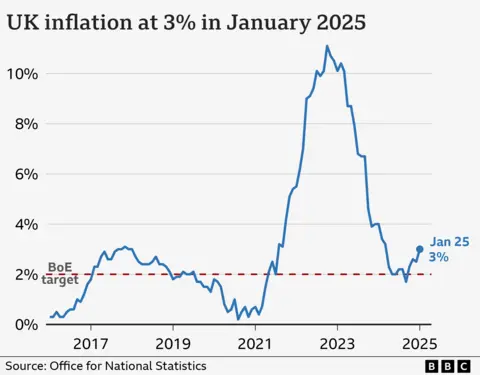

The higher-than-expected jump to 3% in the year to January, from 2.5% in December, means that consumer prices rose at the fastest rate for 10 months.

Private school fees grew by about 13%, according to the Office for National Statistics (ONS), due to VAT being added from 1 January after the government removed the tax exemption.

The cost of meat, bread and cereals also contributed to overall inflation, which is forecast to rise further in the coming months, with higher energy prices set to push up the cost of living for households.

Grant Fitzner, chief economist at the ONS, said the main reason for the surprise inflation spike was due to discounting on goods being “much smaller” than normal at the beginning of the year, especially for airfares.

“We normally see quite a large fall in January in prices, there is a lot of price discounting,” he told the BBC’s Today programme.

Mr Fitzner said the VAT charge on private schools was a “one-off” factor driving inflation, but warned food prices were up “across the board”.

It means that, on average, the cost of buying groceries is 3.1% more expensive than it was a year ago.

Staple goods such as milk, cheese, eggs and bread have all risen in price, the ONS said, as well as coffee, tea, cereals and meat.

While the rise in inflation came as a surprise – economists had expected a reading of 2.8% – it is much lower than its peak of 11.1% in October 2022.

That led to higher interest rates, which has made the cost of loans, credit cards and mortgages, more expensive.

As inflation has eased, the Bank of England has cut interest rates, including a quarter point reduction to 4.5% this month.

But with inflation remaining above the Bank’s 2% target, January’s figure will be “uncomfortable” for policymakers, according to Ruth Gregory, deputy chief UK economist at Capital Economics.

She said the leap was “no surprise, but it was larger than everyone expected”, adding that she doubted it would prevent further interest cuts this year, but that the Bank would reduce borrowing costs “slowly”.

Source link

Unews World

Unews World