Jennifer MeierhansBusiness reporter

PA Media

PA MediaChancellor Rachel Reeves is expected to say her Budget will offer “fair choices” and address “speculation” around her plans when she gives a speech from Downing Street later on Tuesday.

It comes as economists predict Reeves will raise taxes in her 26 November Budget. Labour pledged not to hike income tax, VAT or National Insurance in its general election manifesto.

The Resolution Foundation, an influential think tank, said tax rises are “inevitable” as Reeves looks to balance the books.

Reeves’ speech has been dubbed an “emergency press conference” by shadow chancellor Sir Mel Stride, who said “higher taxes are on the way” and called for her to be sacked if she “breaks her promises yet again”.

The chancellor is set to pledge the upcoming Budget will focus on “fairness and opportunity” to bring down NHS waiting lists, the national debt and the cost of living.

She is expected to say: “You will all have heard a lot of speculation about the choices I will make.

“I understand that – these are important choices that will shape our economy for years to come.

“But it is important that people understand the circumstances we are facing, the principles guiding my choices – and why I believe they will be the right choices for the country.”

The message from Reeves is expected to echo comments made by Prime Minister Sir Keir Starmer to a group of Labour MPs on Monday night.

He told those gathered that the Budget would be “a Labour Budget built on Labour values” and that the government would “make the tough but fair decisions to renew our country and build it for the long term”.

It comes as the Resolution Foundation, which has close links to Labour and was previously run by Treasury minister Torsten Bell, said avoiding changes to VAT, NI or income tax “would do more harm than good”.

Hiking income tax would be the “best option” for raising cash, it said, but suggested it should be offset by a 2p cut to employee national insurance, which would “raise £6 billion overall while protecting most workers from this tax rise”.

Extending the freeze in personal tax thresholds for two more years beyond April 2028 would also raise £7.5 billion, its pre-Budget analysis suggested.

The government’s official forecaster, the Office for Budget Responsibility (OBR), is widely expected to downgrade its productivity forecasts for the UK at the end of the month. That could add as much as £20bn to the amount the chancellor will need to find if she is to meet her self-imposed “non-negotiable” rules for government finances.

The two main rules are:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament

The Treasury declined to comment on “speculation” ahead of the OBR’s final forecast, which will be published on 26 November alongside the Budget.

However, the chancellor confirmed last week that both tax rises and spending cuts are options as she aims to give herself “sufficient headroom” against future economic shocks.

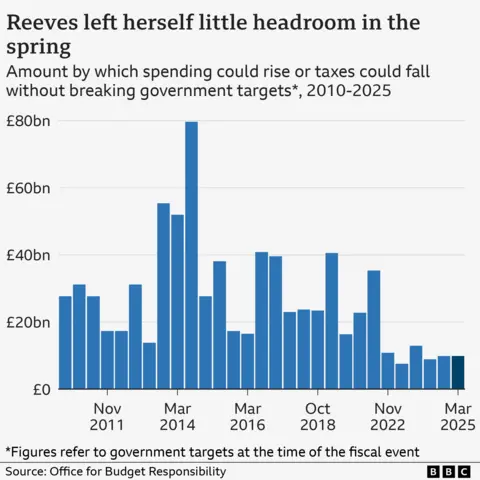

The Resolution Foundation urged the chancellor to use the Budget to give herself more fiscal headroom, meaning how much leeway she has to increase spending or cut taxes without being forced to break her own rules.

After the last Budget, Reeves had £9.9bn of headroom – but the think tank said subsequent policy U-turns and changes in the economic outlook have turned that into a £4bn black hole.

The group said Reeves should double the level of headroom to £20bn in order to “send a clear message to markets that she is serious about fixing the public finances, which in turn should reduce medium-term borrowing costs and make future fiscal events less fraught”.

Last month, the Institute for Fiscal Studies (IFS) said there was a “strong case” to increase fiscal headroom.

The think tank said the lack of a bigger buffer created instability, and could leave the chancellor “limping from one forecast to the next”.

Source link

Unews World

Unews World