Impact of US tariffs on India: India’s GDP may take a hit of around 0.1 to 0.6 percentage points due to the proposed US tariffs, according to a recent Goldman Sachs analysis. The study examines scenarios of US tariff implementation: country-level and product-level reciprocity.

It states, “India’s domestic activity exposure to US final demand would be roughly twice as high (4.0 per cent of GDP) given exposure to the US via exports to other countries, and would likely result in a potential domestic GDP growth impact of 0.1-0.6pp.”

Should the US administration opt to raise tariffs on all imports by the average tariff differential between specific countries and itself, the effective US tariff rates on Indian imports would see an increase of 6.5 percentage points, it says.

On February 13, President Trump directed his team to create a “Fair and Reciprocal Plan”. The subsequent memo outlined a strategy to equalise tariffs, taxes and non-tariff barriers with other nations. During his February 13 press conference, Trump specifically mentioned India alongside the European Union and China, stating that India maintained “the highest tariffs in the world”.

Also Read | ‘More of white noise’: Why Trump’s reciprocal tariffs on India’s exports to US will have a ‘limited’ impact

India-US Trade Dynamics:

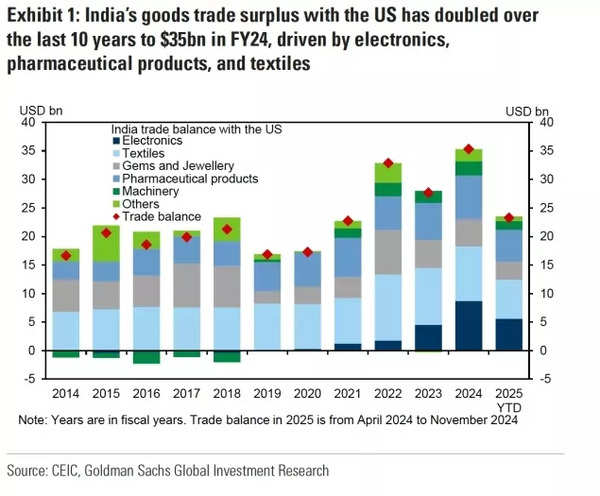

- India’s two-way goods trade surplus with the US has seen a twofold increase in the past decade, rising from $17bn (0.9% of India’s GDP) in FY14 (fiscal year runs from April to March) to $35bn (1.0% of GDP) in FY24.

- The surge is primarily attributed to heightened trade surplus in electronic items, following the implementation of fiscal incentives through the PLI scheme in 2020.

India’s Goods Trade Surplus with the US

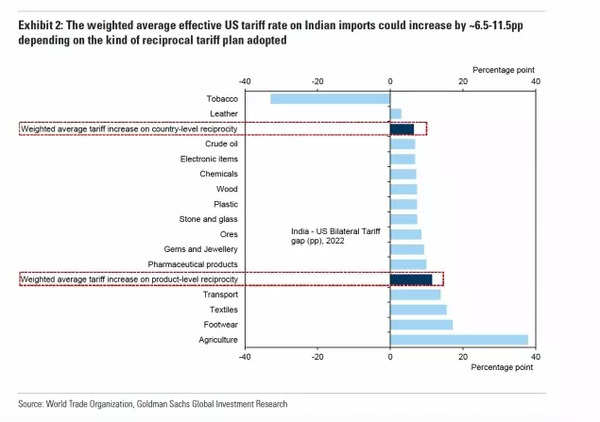

- The tariff structure shows India maintaining higher rates compared to the US across most product categories, with notable differences observed in agricultural products, textiles, and pharmaceutical products.

Weighted Average Effective US Tariff

Goldman Sachs outlines three potential implementation approaches for the “reciprocal tariff” scheme:

1. Country-level reciprocity: The first approach involves country-level reciprocity, where the US administration could raise tariffs on all imports by the average tariff difference between a specific country and the US. This would result in approximately 6.5 percentage points increase in US effective tariff rates on Indian imports. The US economics team suggests this as the most straightforward implementation method, allowing officials to apply a single uniform rate per country on existing tariff rates.

2. Product-level reciprocity: The second method focuses on product-level reciprocity, where the US administration would equalise tariff rates on individual products with those imposed by trading partners. This could lead to roughly 11.5 percentage points increase in US effective tariff rates on Indian imports. This approach requires more complex administration and longer implementation periods. A White House memo dated February 13 requires the Office of Management and Budget (OMB) to provide a report to the President within 180 days.

3. Reciprocity including non-tariff barriers: The third approach encompasses reciprocity including non-tariff barriers, such as administrative obstacles, import licensing requirements, and export subsidies. This represents the most complex implementation method due to difficulties in calculating non-tariff barrier costs for each trading partner. Consequently, the analysis focuses solely on tariff-related barriers.

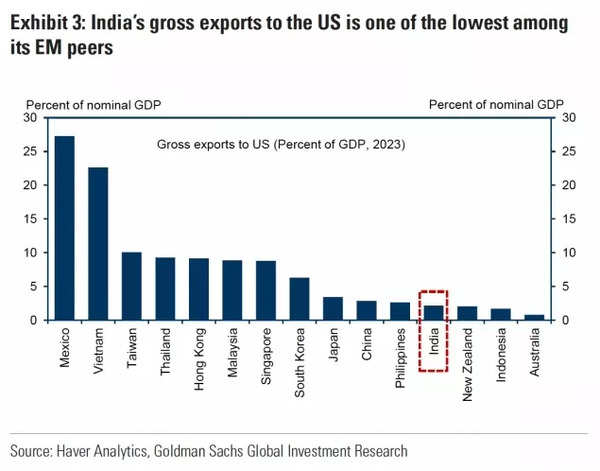

Goldman Sachs’ assessment of India’s vulnerability to US tariff changes begins with examining export exposure. India’s exports to the US accounted for approximately 2.0% of its GDP in 2023, representing one of the smallest exposures amongst emerging market economies.

Also Read | Tesla India entry: Why Donald Trump has said it would be ‘very unfair’ for Elon Musk’s Tesla to set up a factory in India

The key factor in determining the economic impact lies in understanding how responsive Indian exports are to US tariff adjustments, specifically focusing on the price elasticity of American demand for Indian goods.

India’s gross exports to the US

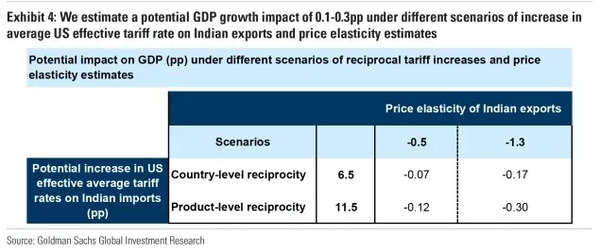

- The analysis considers various scenarios, incorporating different levels of US tariff increases on Indian imports and utilising elasticity estimates from existing research. The calculations suggest that these tariff adjustments could reduce India’s GDP growth by 0.1-0.3 percentage points across different scenarios.

- According to Goldman Sachs, when India’s gross exports to the US amount to approximately 2% of GDP, and considering an 11.5 percentage point rise in average US effective tariff rates on Indian imports with a price elasticity estimate of -0.5, the resultant GDP impact would be 0.12 percentage points (2%*11.5*-0.5=-0.12pp).

Potential impact on GDP

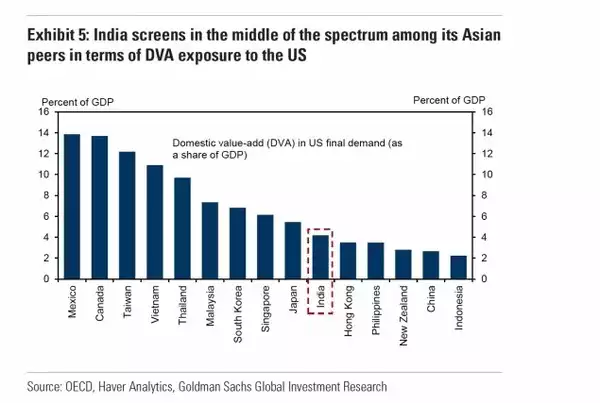

- In the scenario where the US implements a universal reciprocal tariff across all nations, the appropriate indicator for evaluating a domestic economy’s US exposure would be the domestic value added content in gross exports to US final demand, as per the OECD’s Trade in Value-Added Database.

- This indicator precisely measures a country’s domestic activity exposure to the US. With India’s domestic value added content in gross exports at approximately 4.0% of GDP, it positions itself centrally amongst its Asian counterparts. Using this measurement, the potential impact on domestic GDP growth, considering a 6.5-11.5 percentage point increase in US average effective tariff rates, would likely fall between 0.1 and 0.6 percentage points.

India in middle of spectrum

Unews World

Unews World