MUMBAI: For Dalal Street investors, 2024 is a story of two parts, unequally divided. During the first nine months, the two leading indices – the sensex and Nifty – scaled new highs at regular intervals. And then came a sudden burst of foreign fund selling that shaved off a large chunk of the gains from the earlier month.

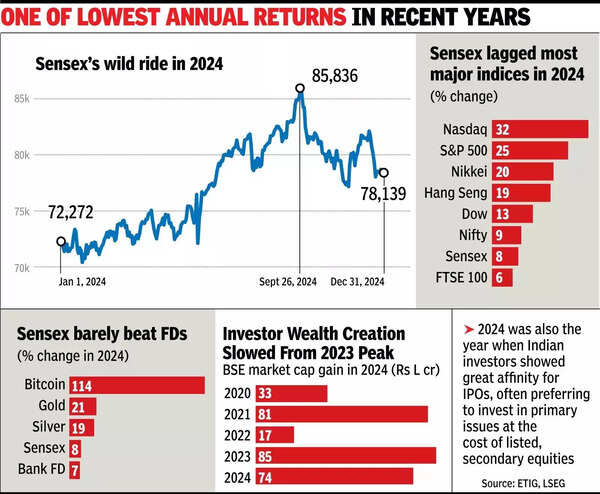

As a result, the two leading indices, after recording its all-time highs at 85,978 points and 26,277 points in end-Sept, fell sharply in the next two months.And after a volatile Dec, on Tuesday the sensex closed at 78,139 points (up 8%) and Nifty at 23,645 points (up 9%) – one of the lowest yearly returns in recent years.

According to Sheetal Malpani, chief investment officer & head of equity, Tamohara Investment Managers, a Sebi-registered portfolio manager, in 2024, the first half saw some good demand for stocks which took benchmark indices higher. In the second half, there was adequate supply, in the form of a large number of IPOs and public offers, which in a way led to subdued annual returns.

Malpani expects some correction in 2025, either a price correction (where the prices move southward to adjust for the valuations to come down to reasonable levels), or a time correction (where prices remain constant but earnings growth, over a few quarters, adjust the valuations to come down to reasonable levels). There is also a possibility for both the corrections to kick in in phases. “Since April 2020 new investors have not seen any reasonable correction in the stock market. So, it needs to be seen how the new lot behaves during a corrective phase,” Malpani said.

The year also witnessed investors remaining more bullish on small and midcap stocks over blue chips. According to data from NSE, compared to single-digit percentage return by nifty, its midcap 50 index returned 21.5% while the smallcap 50 returned a little over 25%.

2024 was also the year when Indian investors showed great affinity for IPOs, often preferring to invest in primary issues at the cost of listed, secondary equities.

Unews World

Unews World